Renters Insurance in and around Weston

Your renters insurance search is over, Weston

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

There's a lot to think about when it comes to renting a home - location, number of bedrooms, size, condo or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Your renters insurance search is over, Weston

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

When the unexpected tornado happens to your rented property or townhome, generally it affects your personal belongings, such as a set of favorite books, a tool set or a microwave. That's where your renters insurance comes in. State Farm agent Brittany Pinkney wants to help you evaluate your risks so that you can keep your things safe.

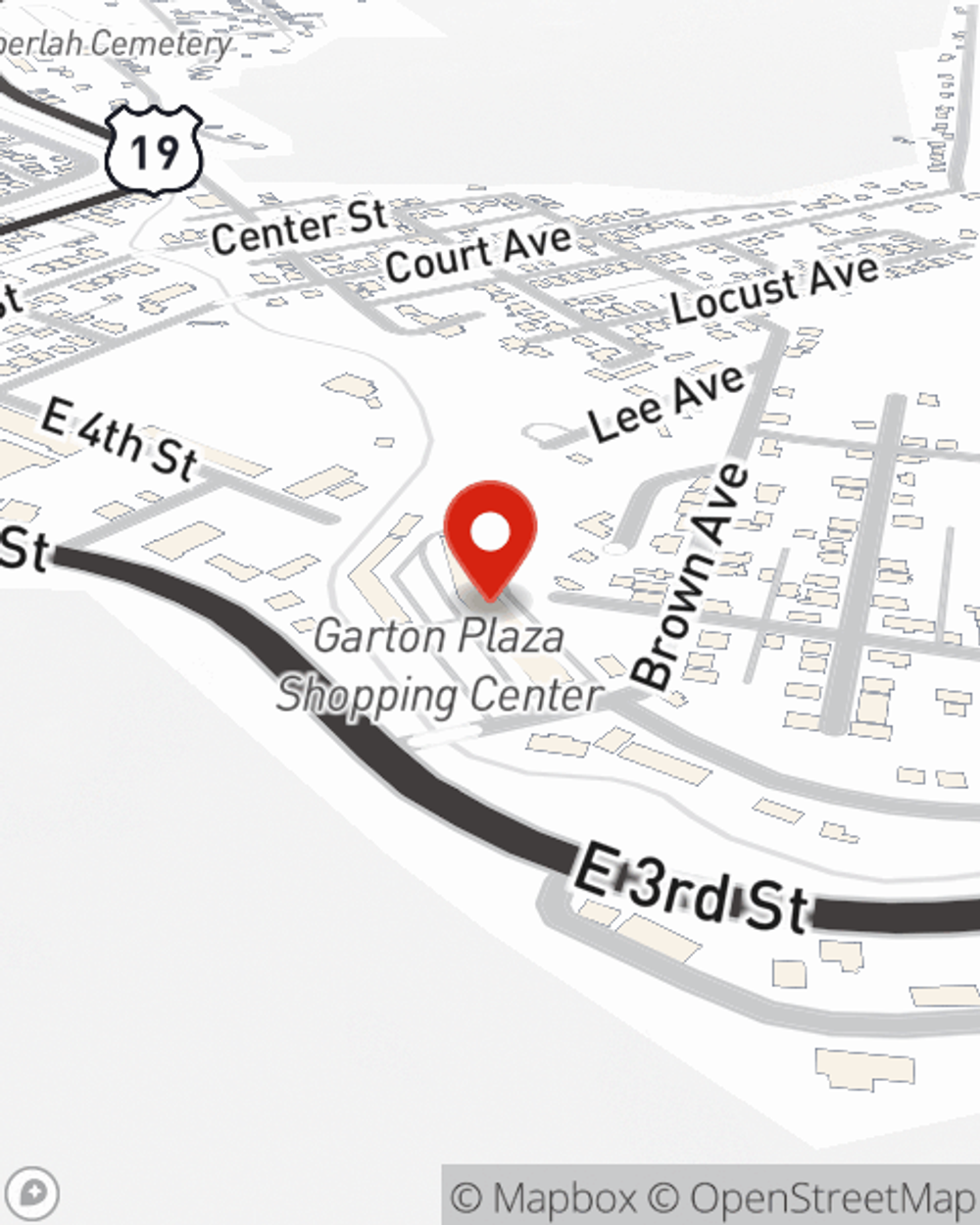

Get in touch with State Farm Agent Brittany Pinkney today to find out how a State Farm policy can protect your possessions here in Weston, WV.

Have More Questions About Renters Insurance?

Call Brittany at (304) 269-2727 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Brittany Pinkney

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.